Recap of CES 2014

Before all the new announcements in the U.S., the audiences were briefly reminded couple things that happened in 2014.

-Samsung shared its vision for Home of the Future, a lifestyle-based innovation that will extend across the overall eco-system

-Samsung Electronics Honored with 36 CES Innovation Awards including 2 Best of Innovation awards (Bendable S-UHD TV, Galaxy Note Edge) and 4 Eco-Design honors across all the business categories.

-Samsung outperformed in the US market with two digit number growth in sales and believes that it reached more loyal consumers.

-Samsung successfully established a new television category ? Curved UHD.

-Samsung introduced CHEF Collection, a new generation of appliances

Key Announcements

Similar to the prior CES, Samsung has announced many new innovative products such as TVs, home appliances and more. Here are some of the key points of each new announcements.

#1 Samsung Portable SSD T1

-Smaller than a business card, it weighs less than an ounce

-Four times faster than the traditional external drive

-Holds up to a terabyte of data

#2 Milk Music, Video & VR

-Milk started as an intuitive music-discovery app for millions of active users worldwide.

-MILK Video allows you to discover, collect, and share all of the web’s best videos, seamlessly, in one place.

-In 2015, Samsung is expanding MILK to Samsung Smart TVs, and MILK Music to the web.

-Milk VR is an exclusive service for Gear VR with a daily stream of immersive, 360 degree videos.

-Milk VR is available for download right now from the Oculus store on the Samsung Gear VR.

-Samsung is launching with 100 minutes of original content and will deliver 10 new videos per week, from music, sports, to action and lifestyle.

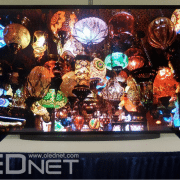

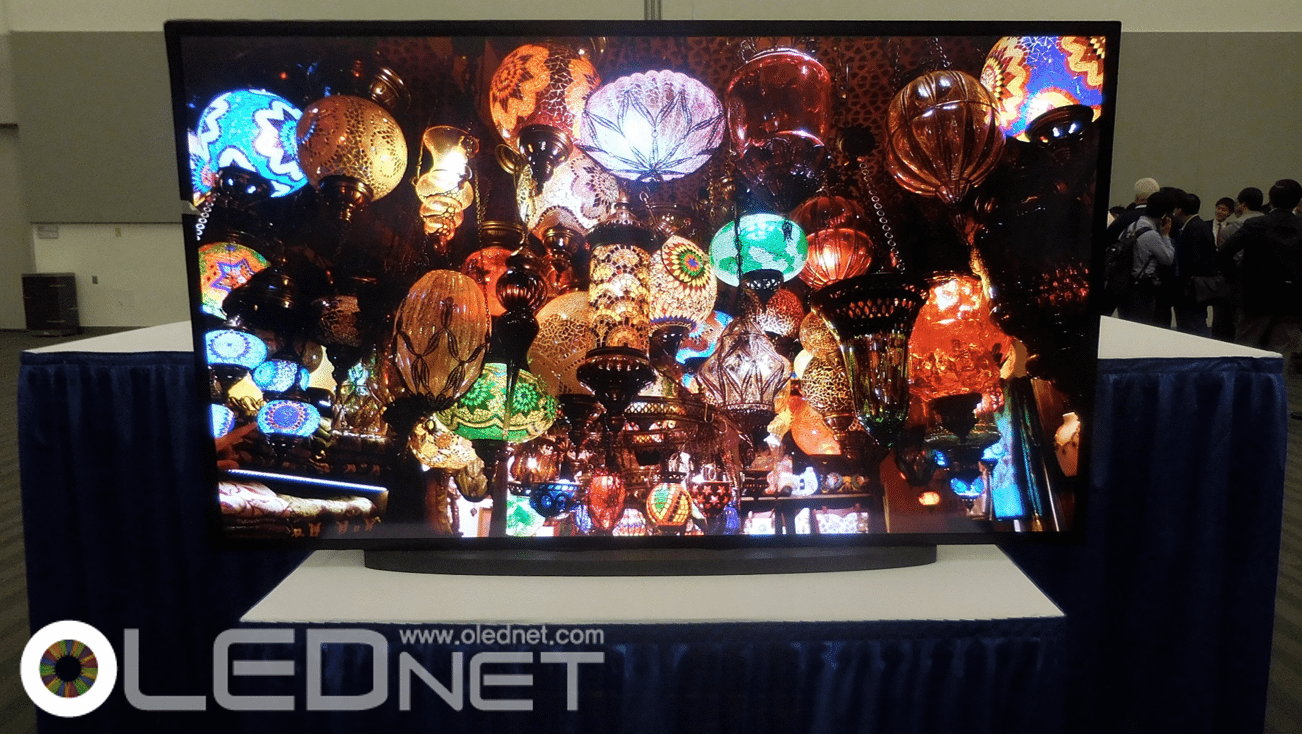

#3 Curved S-UHD TV

-This is Samsung’s first SUHD TV and it is 88-inch!

-The SUHD display is made from Samsung’s proprietary nano-crystal semiconductors

-It delivers the highest color purity and light efficiency available today.

-Quantum Color technology gives 64 times the color expression of conventional TVs for the most accurate color display.

#4 Smart TV

-From this year, all Samsung Smart TV’s ? including our SUHD TV ? will be powered by the Tizen operating system, which is based on web standards

-The “first screen menu” simplifies the Smart TV experience whether you control your TV with a remote, or voice, or gestures.

-Samsung Quick Connect instantly links up devices to your TV.

-Smart TV offers easy and seamless navigation across videos, games and the web, giving you more choices than ever on the TV screen

-Samsung Sports Live brings the second-screen experience on to the main screen and provides near real-time stats about the team and the players

-Samsung partnered up with PlayStation Now, which lets you stream&play blockbuster games without a console, and multiscreen games

#5 WAM7500/6500

-The newly-introduced 8500 series will also offer enhanced sound quality with its 9.1 channel speakers

-It provides omni-directional experience

-Samsung’s ring radiator technology projects sound in all directions, vertically and horizontally.

-Multiroom App 2.0, which uses the Milk interface.

CHEF Collection phase 2

#6 Chef Collection App

-This app is updated every two weeks, and packed with recipes and tips from these incredible Michelin-starred chefs as well as partners

-It is like having your own Michelin-starred adviser next to you

-The Chef Collection App will be available for free on Google Play starting in February.

#7 Flex Duo with Dual Door

-The Flex Duo with Dual Door aims to deliver efficient use of compartments incorporating top Chefs’ direct feedback on usability as well as efficiency.

-The upper door provides access to a small top compartment.

-The full door opens both the top and bottom compartments, when the Smart Divider is slotted in.

#8 WA8700 Top-load washer with activ dualwashTM & SuperSpeedTM

-Samsung is the innovator and clear industry leader, with the highest capacity washers and dryers on the market, and phenomenal energy efficiency across the board.

-A new built-in sink, complete with water jet and scrubber makes doing the laundry easier ? while still maintaining load capacity.

-One-stop solution for all your laundry needs

-Activewash is also our first top loader to feature Super Speed technology, which reduces the wash time for a normal load to as little as 36 minutes.

-For the first time on top-load washers, WA8700 features SuperSpeedTM enabling users to save more “me” time.

-Wash Sink and Water Jet make it all possible ? one-stop solution.

#9 PowerBot Robot V/C

-The new Powerbot has 60 times more suction power compared with conventional robot vacuum cleaners.

-It will create a complete map of the home to calculate the most efficient c

leaning path, thanks to Visionary Mapping Plus.

![150309_ [Lighting Fair Japan 2015]LG Chem., 2015년 4월 100lmW의 OLED lighting panel 양산 가능3](http://www.olednet.com/wp-content/uploads/2015/03/150309_-Lighting-Fair-Japan-2015LG-Chem.-2015년-4월-100lmW의-OLED-lighting-panel-양산-가능3.png)

![150309_ [Lighting Fair Japan 2015]LG Chem., 2015년 4월 100lmW의 OLED lighting panel 양산 가능2](http://www.olednet.com/wp-content/uploads/2015/03/150309_-Lighting-Fair-Japan-2015LG-Chem.-2015년-4월-100lmW의-OLED-lighting-panel-양산-가능2.png)

![150306_[Lighting Fair Japan 2015]LG Chem., 유럽에 이어 한국과 일본에 본격적인 OLED lighting 마케팅 시작](http://www.olednet.com/wp-content/uploads/2015/03/150306_Lighting-Fair-Japan-2015LG-Chem.-유럽에-이어-한국과-일본에-본격적인-OLED-lighting-마케팅-시작.png) <Front View of LG Chem Booth, Lighting Fair Japan 2015>

<Front View of LG Chem Booth, Lighting Fair Japan 2015>

![150303_[MWC2015]Smart Watch Trend, LG Electronics is On It](http://www.olednet.com/wp-content/uploads/2015/03/150303_MWC2015Smart-Watch-Trend-LG-Electronics-is-On-It.png)

![150303_[MWC2015]Smart Watch Trend, LG Electronics is On It1](http://www.olednet.com/wp-content/uploads/2015/03/150303_MWC2015Smart-Watch-Trend-LG-Electronics-is-On-It11.jpg)

![150303_[MWC2015]Samsung Electronics’ Galaxy 6 and the ‘ultimate weapon’ Galaxy S6 Edge](http://www.olednet.com/wp-content/uploads/2015/03/150303_MWC2015Samsung-Electronics’-Galaxy-6-and-the-‘ultimate-weapon’-Galaxy-S6-Edge1.png) <Galaxy S6 Edge, Samsung>

<Galaxy S6 Edge, Samsung>