삼성, 중소형 OLED 3조 투자 “추격자 따돌린다”…外

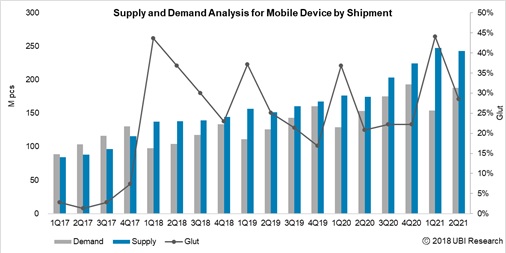

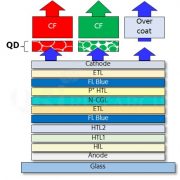

[디지털데일리=김도현 기자] 삼성디스플레이가 중소형 유기발광다이오드(OLED) 투자에 나선다. 지난 2017년 이후 약 4년 만이다. 28일 업계에 따르면 삼성디스플레이는 충남 아산캠퍼스 L7-2라인을 A4E(가칭)로 전환할 방침이다. 액정표시장치(LCD)에서 OLED 공장으로 탈바꿈이다. 삼성디스플레이는 LCD를 제조하던 L7-2라인 설비를 철거 중이다. 지난 3월 가동을 멈추고 협력사 와이엠씨가 4월부터 해체 작업을 시작했다. 오는 7월20일 마무리 예정이다. 기존 계획보다 열흘 정도 앞당겼다. 관련 설비는 매각 대상을 물색하고 있다. 이곳은 6세대(1500mm*1850mm) OLED 라인으로 전환될 예정이다. 최근 스마트폰을 비롯한 노트북 태블릿PC 등 정보기술(IT) 기기의 OLED 채택률이 높아진 영향이다.

- LG디스플레이, 무신사 홍대 매장에 ‘투명 OLED’ 쇼윈도 공급

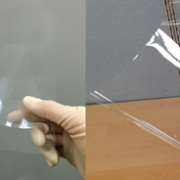

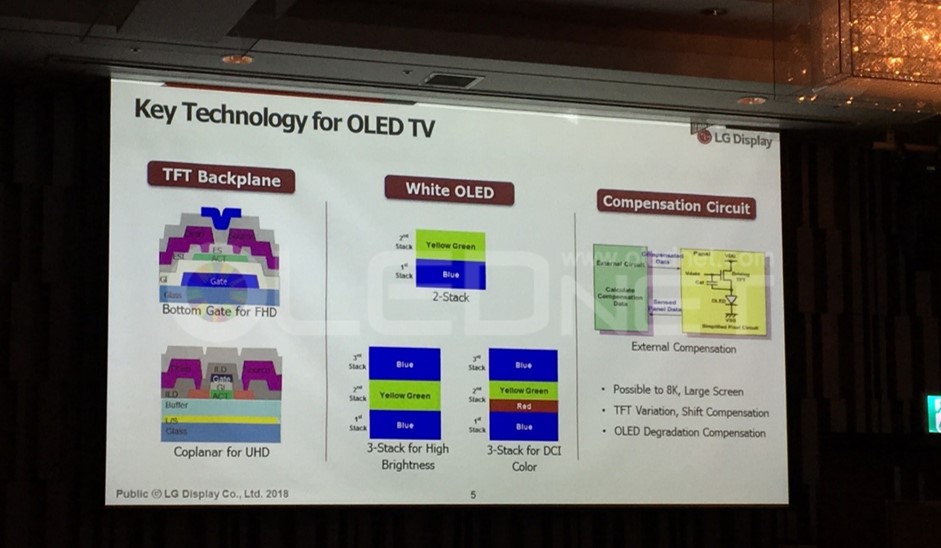

[연합뉴스=김철선 기자] LG디스플레이는 국내 최대 온라인 패션 플랫폼 ‘무신사’가 최근 연 첫 정식 매장 ‘무신사 스탠다드 홍대’에 인테리어용 투명 OLED를 공급했다고 31일 밝혔다. 매장 내 설치된 55인치 투명 OLED 쇼윈도는 각종 제품 정보를 실시간으로 보여줄 뿐만 아니라, 쇼윈도 속 실제 제품에 가상 이미지를 겹치는 방식으로 여러 콘텐츠를 표현한다. 매장 곳곳에는 LG디스플레이와 무신사, 그리고 유명 뮤직비디오 감독 룸펜스가 협업해 제작한 투명 OLED 미디어 아트 작품도 전시해 방문객들에게 볼거리를 제공한다. 투명 OLED는 백라이트 없이 화소 스스로 빛을 내 투명도가 높으면서 얇고 가벼운 디자인 구현이 가능하다.

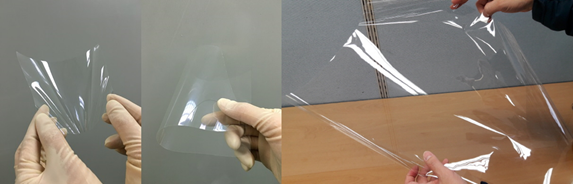

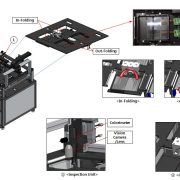

[전자신문=윤건일 기자] 삼성디스플레이가 폴더블 디스플레이 커버윈도로 사용되는 울트라신글라스(UTG)를 삼성전자 외 다른 스마트폰 업체에도 공급한다. 자회사이자 UTG 제조사인 도우인시스와 시너지가 주목된다. 30일 업계에 따르면 삼성디스플레이는 폴더블 디스플레이 사업 강화를 위해 UTG를 다른 스마트폰 제조사에도 판매할 계획인 것으로 파악됐다. 구글이 준비하고 있는 폴더블폰에 삼성디스플레이가 만든 폴더블 유기발광다이오드(OLED) 패널과 UTG가 함께 적용될 예정이다. UTG는 삼성디스플레이가 자회사 도우인시스와 세계 최초 상용화한 접히는 유리다. 얇게 가공된 유리에 유연성과 내구성을 높이는 강화 공정을 거쳐 접었다 펼 수 있게 만들었다. 이 UTG는 그동안 삼성전자에만 공급됐다. 삼성전자 폴더블폰의 차별화를 위해서다. 유리는 심미성이 뛰어나 플라스틱 소재보다 고급스러운 느낌을 구현할 수 있는데, 다른 스마트폰 업체들은 이 기술을 확보하지 못했다.

[조선비즈=이광영 기자] LG전자가 자사 첫 미니LED TV인 ‘LG QNED’를 6월 중순 이후 글로벌 시장에 순차 출시한다. 2020년 12월 온라인 TV 기술설명회를 통해 공개된 이 제품은 올 상반기 내 출시하겠다는 약속을 우여곡절 끝에 지키게 됐다. LG QNED의 출격을 가로막은 것은 기대 이상으로 선전한 올레드(OLED) TV의 존재감이다. 핵심 부품인 LCD 패널 가격 상승도 일부 영향을 미쳤다. 28일 LG전자 내부 사정에 정통한 한 관계자는 “LG전자는 멕시코 레이노사와 인도네시아 찌비뚱에 위치한 TV 공장에서 조만간 LG QNED 생산에 돌입할 예정이다”며 “6월 중순부터 북미, 호주, 유럽, 한국 등 글로벌 시장에 순차적으로 판매할 것으로 보인다”고 밝혔다. TV 업계 일각에서는 LG전자가 의도적으로 LG QNED의 마케팅이나 판매 일정을 조정한다는 분석이 나왔다. 자사 주력 제품인 올레드 TV 판매량에 영향을 줄 수 있어서다.

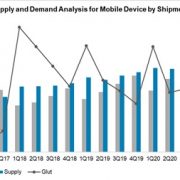

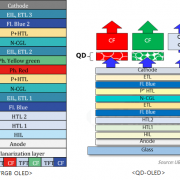

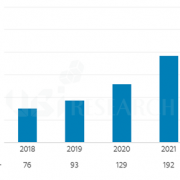

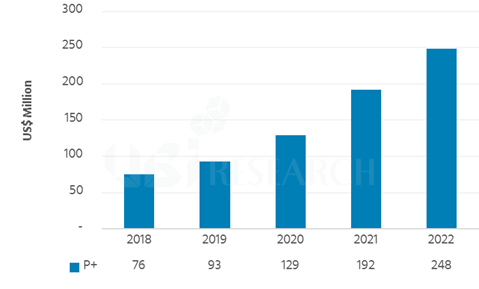

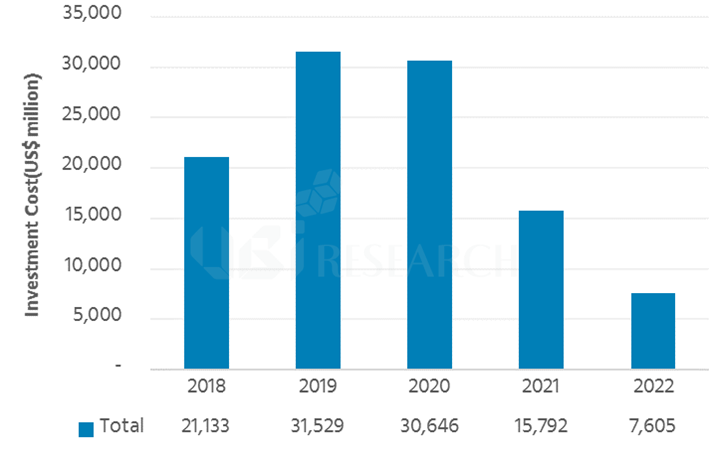

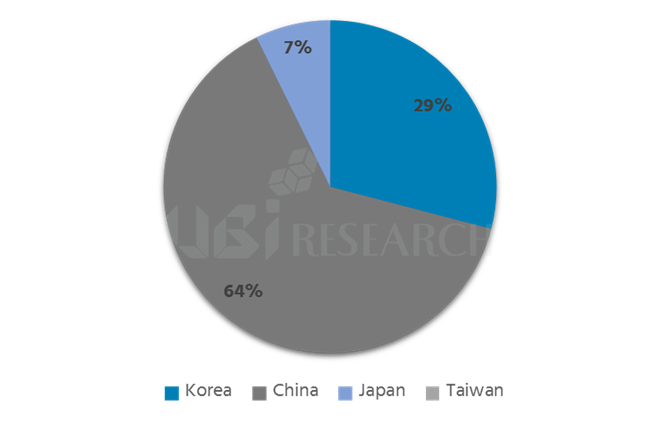

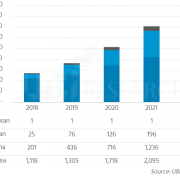

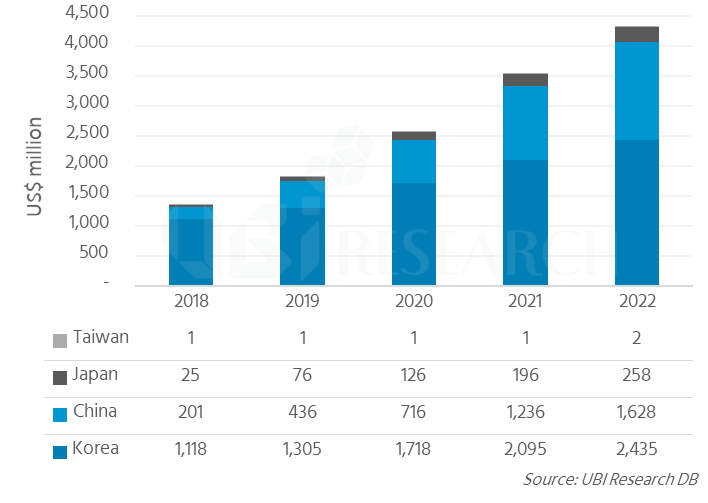

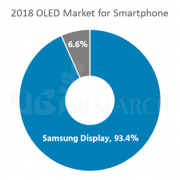

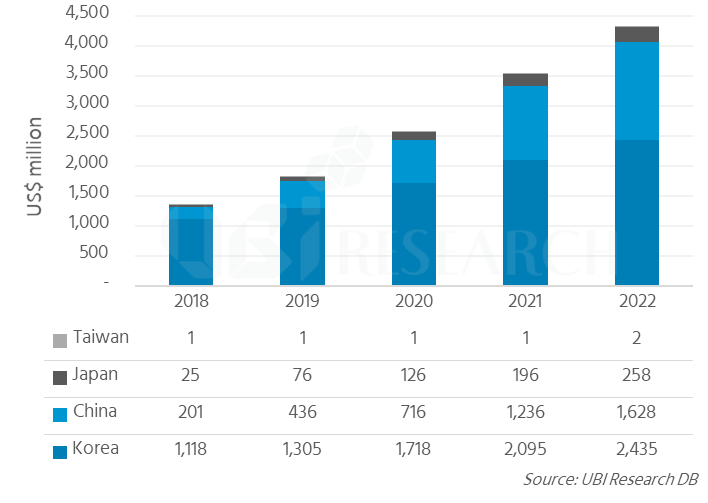

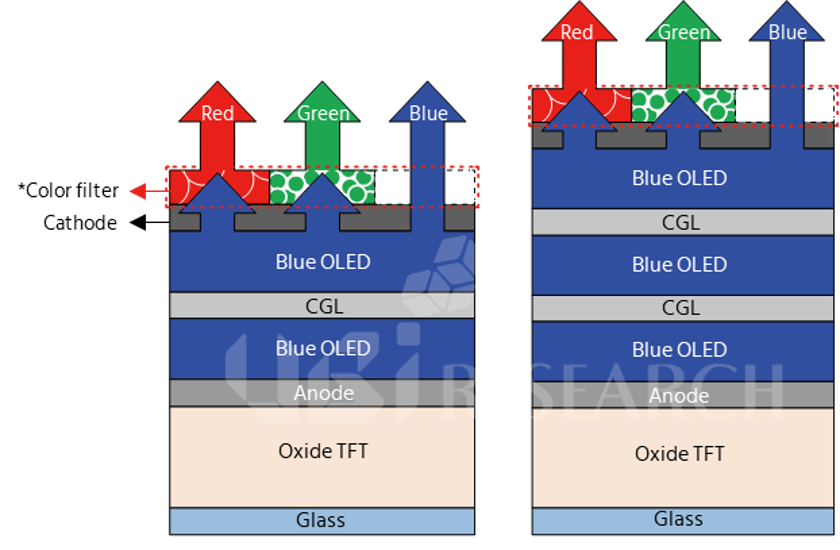

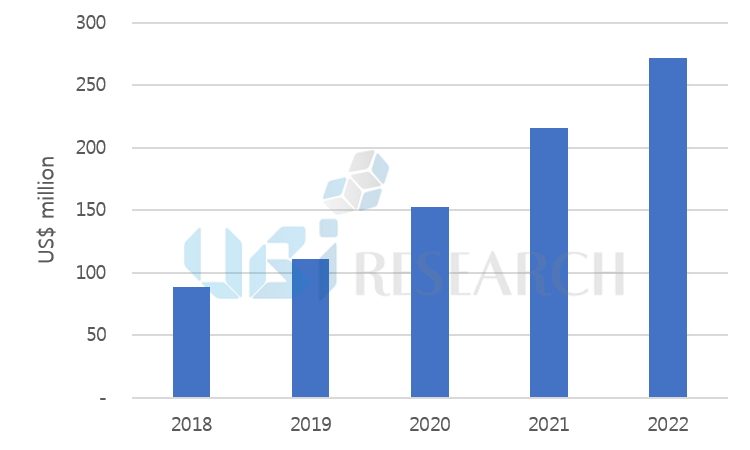

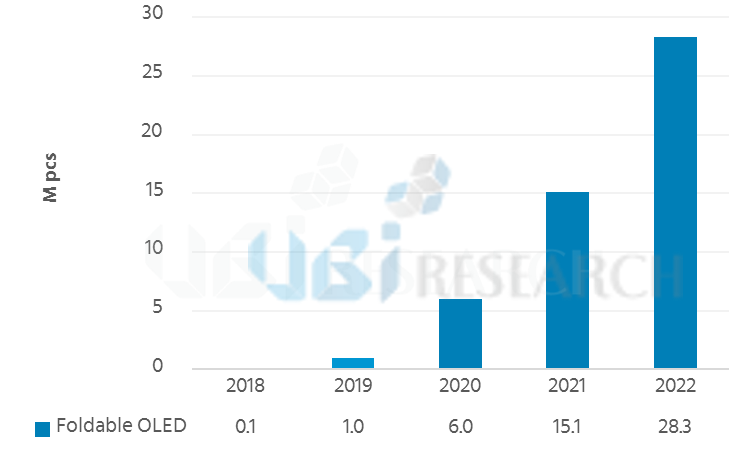

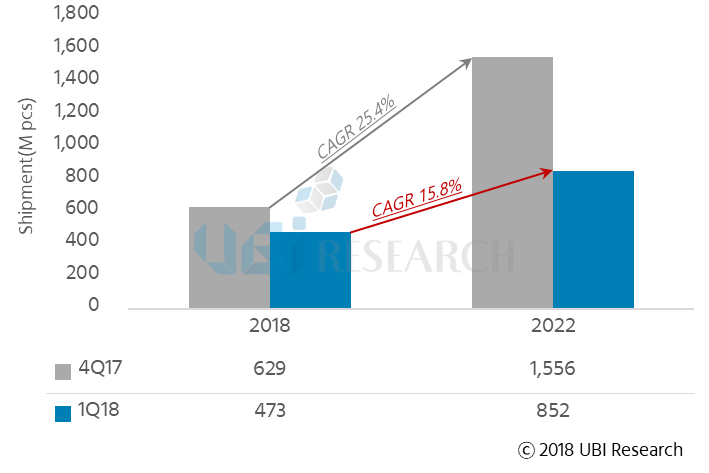

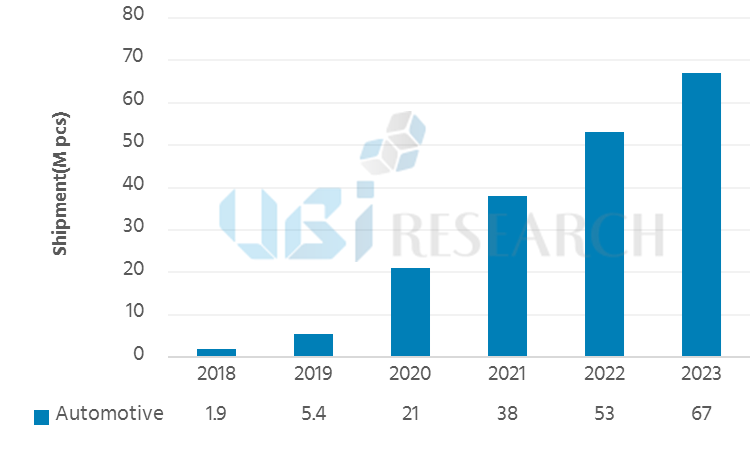

[ZDNet=박영민 기자] 코로나19 확산과 미국 정부의 화웨이 제재에도 중국 유기발광다이오드(OLED) 시장 성장세가 가파르다. 고해상도 모바일 디스플레이 선호 추세가 이어지면서 주요 패널 기업이 생산하는 모바일 OLED 판매가격도 오르고 있다는 분석이다. 31일 시장조사업체 유비리서치가 발간한 ‘중국 OLED 동향 보고서’에 따르면 올해 1분기 중국 스마트폰 OLED 매출액은 9억9천만 달러(약 1조1천39억원)로 집계됐다. 지난해 같은 기간보다 38.3% 늘어난 수치다. 화웨이와 오포, 비보, 샤오미 등 중국 스마트폰 제조사가 중고가 OLED 스마트폰 시장 점유율을 확대하면서다. 같은 기간 중국 시장에 출시된 OLED 스마트폰 종류는 전년 27종보다 2배 이상 늘어난 57종으로 집계됐다. 유비리서치 관계자는 “중국 디스플레이 기업들은 액정표시장치(LCD) 생산량 1위로 등극한 데 이어, OLED 생산 기술도 상당한 수준에 도달해 최고의 난이도가 요구되는 폴더블 OLED도 직접 생산 중”이라며 “화웨이와