UBI research just issued 2018 2Q AMOLED Display Market Tracks

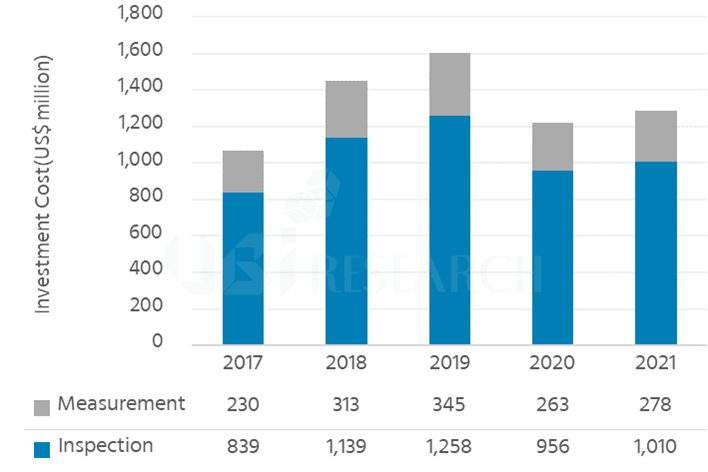

UBI Research recently published “2Q18 AMOLED Display Market Tracks”, which includes market updates of the second quarter of 2018. The report covers OLED display panel makers’ investment status, OLED display market forecasts from 2018 to 2022, OLED demand and supply trends, and competitiveness analysis of OLED Smartphone business for Samsung Display and other OLED display panel makers.

The market update, published with the Excel spreadsheet, describes the production line status and the added line status through future investments of the 15 OLED display panel makers worldwide. Also, it describes not only the major OLED application market such as smart phones and TVs, but also the market forecast by country.

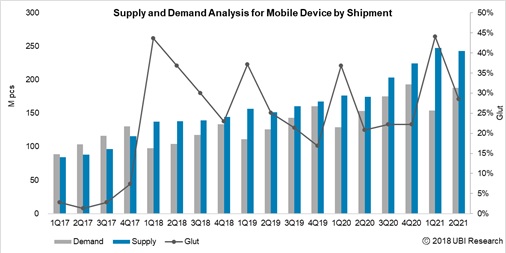

The demand for OLED mobile sets (including smart phones and smart watches) in the first quarter of 2018 dropped to 98 million units from 130 million units in the fourth quarter of last year, due to the lower-than-expected performance of the premium smartphone market, where Samsung Electronics’ Galaxy S series and Apple’s iPhone occupy most of the market. OLED mobile set market is to recover gradually until 3Q, when Apple’s new smartphone model is launched, and by the end of 2018, the demand is expected to recover as to the similar level of the same period of last year. In addition, Samsung Display is anticipated to have a positive impact on the recovery of the Smartphone market in the second half of the year by securing competitiveness by lowering the sales price of rigid OLED panel for mobile phone to about US$ 25 to compete with LCD in China.

Consumers' smartphone replacement cycle is getting longer due to the reason that there is no revolutionary change in the new model compared to the past, and the Smartphone penetration in most of the countries except for India, South America and Africa is reaching the limit. Accordingly, the outlook for the downturn is mostly forecasted in the recent smartphone market. There is a growing interest in technology and design to apply a different form factor to revive the market. In this regard, Samsung Electronics' foldable OLED smartphone, which is scheduled to be released later this year or early next year, is expected to create a new momentum. Attention is focused on whether a folding- type flexible display (Dynamic Flexible Display) will be succeeded as a new type of smartphone from the existing edge-type flexible display (Static Flexible Display).

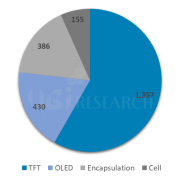

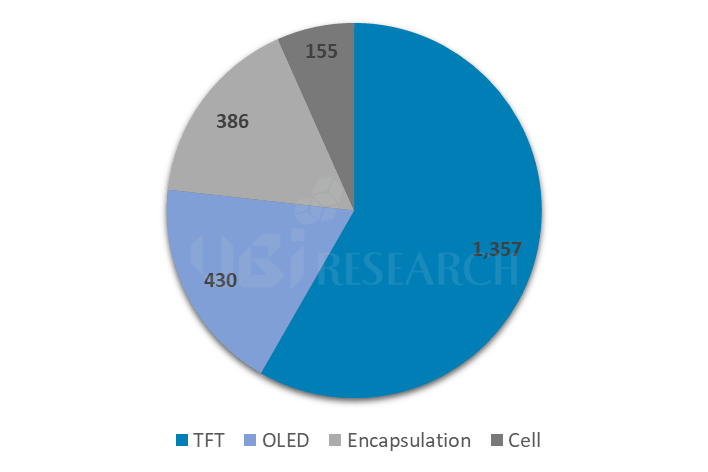

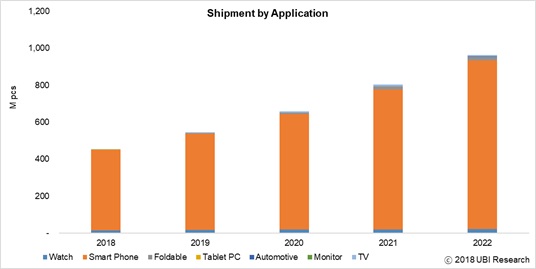

UBI Research predicts that the OLED Smartphone market will grow from 430 million units in 2018 to 900 million units in 2022, and the market for foldable OLED Smartphone is to be from about 1million units in 2019 to 18million units in 2022. This reflects the expansion of OLED panel production lines by panel makers such as LG Display and BOE, besides Samsung Display. It will be updated as new applications are developed in future and the Smartphone market moves forward.

In OLED panel market, OLED panel for Smartphone still occupies 91% of the whole market. Samsung Display has accounted for 90% of total OLED panel market performance and LG Display is followed with about 7.8% share.

OLED TVs, which are continuously increasing in demand worldwide compared to the Smartphone market, are expected to be in short supply this year. LG Display, the only OLED TV panel supplier, will continue to invest in production for the next five years. With the recent approval of new production facility for OLED TV panel in Guangzhou, the full-scale equipment move-in is expected this year. In Paju P10 investment plan, it was confirmed that LG Display will invest in OLED TV panel production line instead of LCD line investment which was examined before. Thus, the OLED TV market is projected to grow to US $ 5.6 billion.