Source = Samsung

Samsung Electronics today announced financial results for the second quarter ended June 30, 2016. Samsung’s revenue for the quarter was KRW 50.94 trillion, an increase of KRW 2.40 trillion YOY, while operating profit for the quarter was KRW 8.14 trillion, an increase of KRW 1.24 trillion YOY.

The second quarter saw significant earnings growth led by strong performance both in the set and component businesses. Overall earnings of the set business improved YOY as well as QOQ due to the continuous sales increase of premium products.

The IT & Mobile Communications (IM) Division saw substantial earnings improvement led by expanded sales of flagship products such as the Galaxy S7 and S7 edge. A streamlined mid-to low-end smartphone lineup also contributed to improved profitability. Operating profit for the IM Division was KRW 4.32 trillion.

The Consumer Electronics (CE) Division achieved significant earnings growth YOY led by strong sales of its premium lineup such as SUHD TVs, Chef Collection Refrigerator, AddWash washer and newly launched air conditioner.

The component business achieved solid performance although overall earnings decreased YOY due to ASP declines in the industry. Earnings for the Display Panel segment improved QOQ led by increased OLED capacity utilization and stabilized LCD panel yields. Demand for semiconductors for mobile and SSD increased and the company achieved solid growth with a competitive edge in differentiated products, including 20-nanometer DRAM, V-NAND and 14-nanometer mobile AP.

The company estimated that the stronger Korean won against major currencies in the second quarter negatively impacted operating profit by approximately KRW 0.3 trillion, reflected mainly in the component business earnings.

Looking ahead to the second half of 2016, the company expects its solid performance to continue compared to the first half, mainly driven by earnings increase in the component business due to sales growth in high value-added products and stable demand and supply conditions. The set business is expected to continue its stable earnings while the IM Division expects marketing expenditure to increase.

In the third quarter, the company expects the component business to maintain its solid performance due to improved demand and supply conditions for memory chips and LCD panels and stable earnings for OLED and System LSI. For the set business, the company forecasts marketing expenditure for the IM business to increase mainly due to a new flagship product launch and fierce competition in the industry. Meanwhile, weak seasonality is likely to impact the CE business.

Capital expenditure (CAPEX) for the second quarter was KRW 4.2 trillion, which includes KRW 2 trillion for the Semiconductor business and KRW 1.6 trillion for the Display Panel business. The accumulated total CAPEX for the first half was KRW 8.8 trillion.

The annual plan for CAPEX has not yet been confirmed but is projected to increase slightly compared to last year. This year’s CAPEX will be concentrated on OLED and V-NAND capacity as the company sees strong market demand for OLED panels for smartphones and V-NAND SSD.

Demand for High-Density, High-Valued Products Drives Higher Earnings

The Semiconductor business posted KRW 12 trillion in consolidated revenue and KRW 2.64 trillion in operating profit for the quarter.

The memory business enjoyed solid growth in demand in the second quarter. Orders for high-density NAND and DRAM products contributed to solid earnings QOQ. This was coupled by a reduction in cost from continuous process migration.

In NAND, shipments of SSD remained strong in the quarter, as enterprise companies increasingly made the transition from HDD to SSD so as to reduce total cost of ownership (TCO). Orders for high-density mobile storage products over 32GB also helped drive sales, mainly due to the expanded adoption by Chinese companies. Samsung actively responded to orders for high-density mobile products over 64GB and enterprise SSD over 4TB and increased supply of the industry’s first 48-layer V-NAND.

In DRAM, demand climbed QOQ as smartphone manufacturers bought more high-density mobile DRAM and demand for high-density products increased following the launch of a new server platform.

A supply imbalance of some applications led to greater demand for Samsung’s 20-nanometer high-density, high value-added mobile and server products.

Looking ahead, for NAND, increased adoption of high-density products and strong seasonality will further drive demand growth in the second half. Growth in high-density, premium SSD products will continue, and the launch of new products by smartphone manufacturers is expected to raise demand for mobile storage. However, supply and demand will be tighter in the second half, due to soft industry supply growth.

For DRAM, the launch of new smartphones and the increasing adoption of 6GB memory chips in high-end smartphones will spur shipments of mobile DRAM in the second half. Shipments of high-density server products will be strong, as more data centers make the transition to a new server platform.

The System LSI business saw gains QOQ, thanks to stronger demand for 14-nanometer mobile AP in premium smartphones and increased sales of high megapixel image sensors. In the second half, increased sales of mid- to low-end mobile AP and LSI products are expected to provide a stable revenue stream.

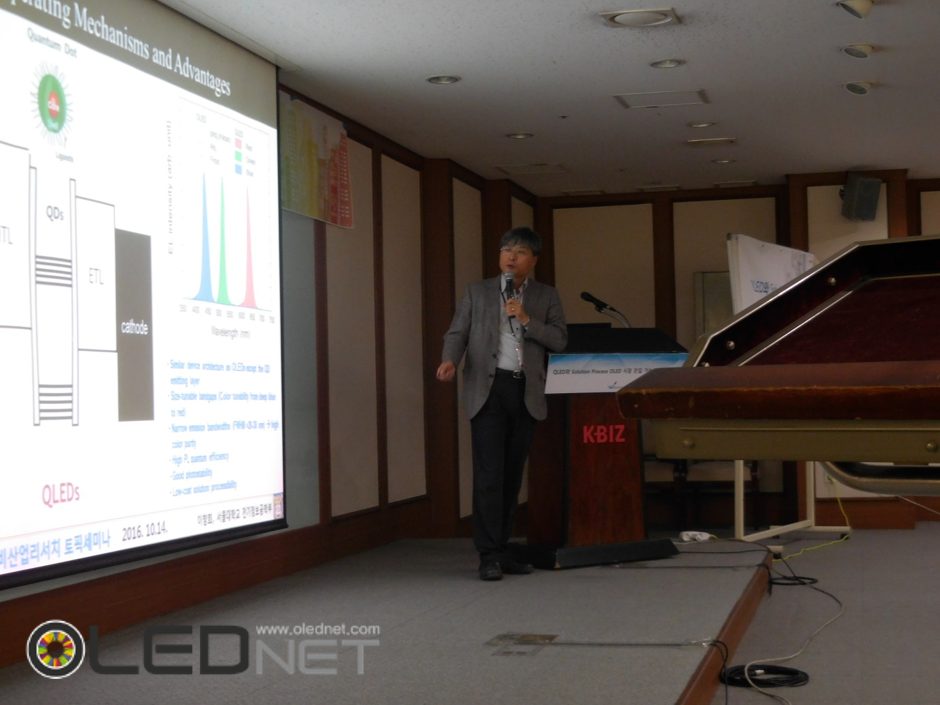

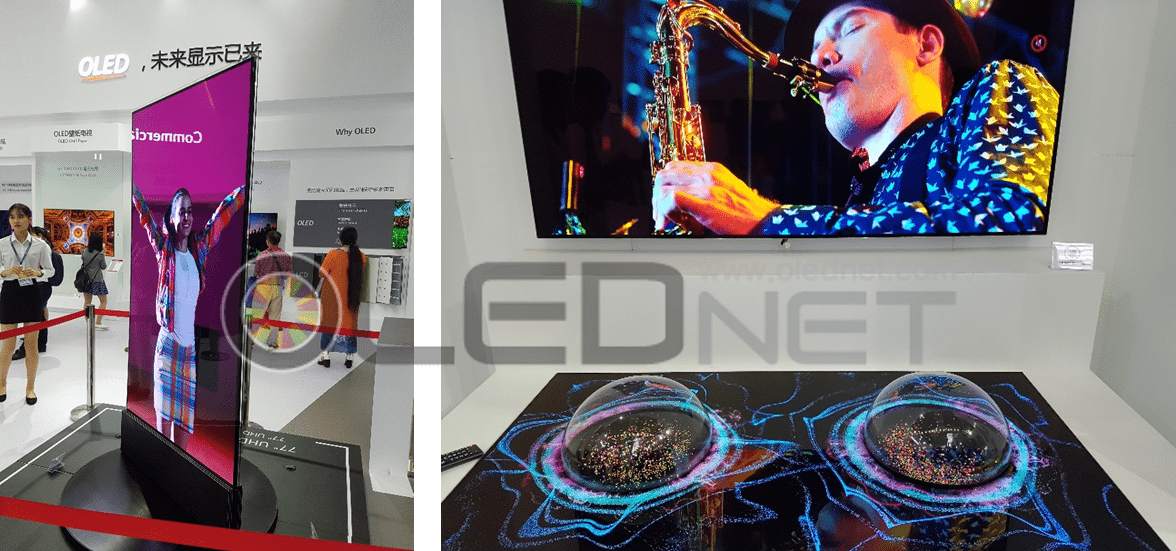

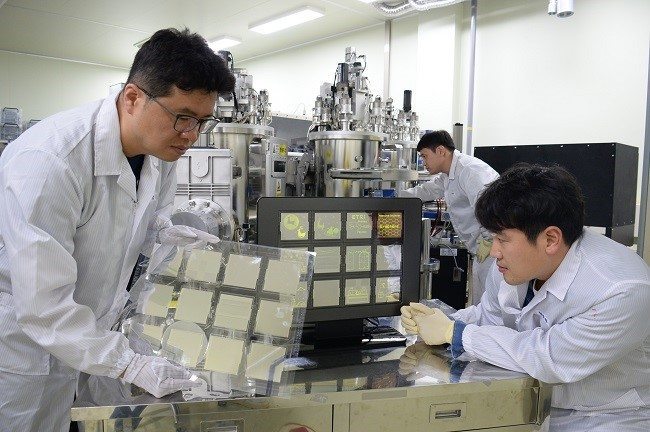

Improved Display Performance on Strong OLED Sales and LCD Recovery

The Display Panel segment posted KRW 6.42 trillion in consolidated revenue and KRW 0.14 trillion in operating profit for the quarter driven by increased shipments of OLED panels and enhanced yields for new LCD TV panel production technology.

For the OLED business, second quarter earnings improved QOQ due to healthy sales of flagship smartphones and increased demand for flexible panels. High fab utilization rates with the help of an expanded mid to low-end product portfolio also contributed to improved earnings.

For the LCD business, the second quarter saw a continuation of QOQ growth under a gradual recovery in the supply-demand balance. The company was able to achieve growth thanks to improved yields for new TV panel production technology as well as expanded TV sales particularly for large-sized UHD panels.

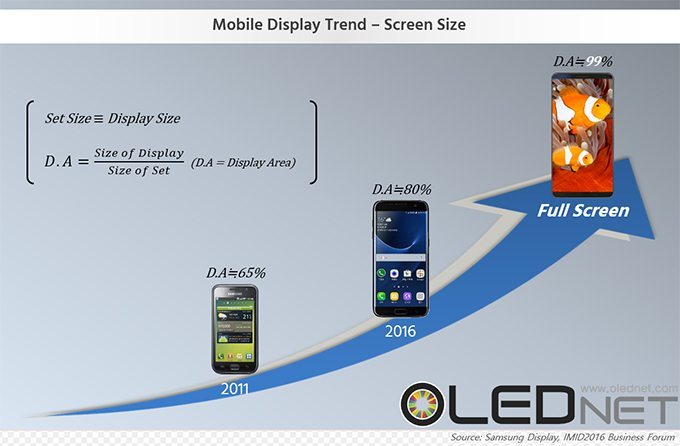

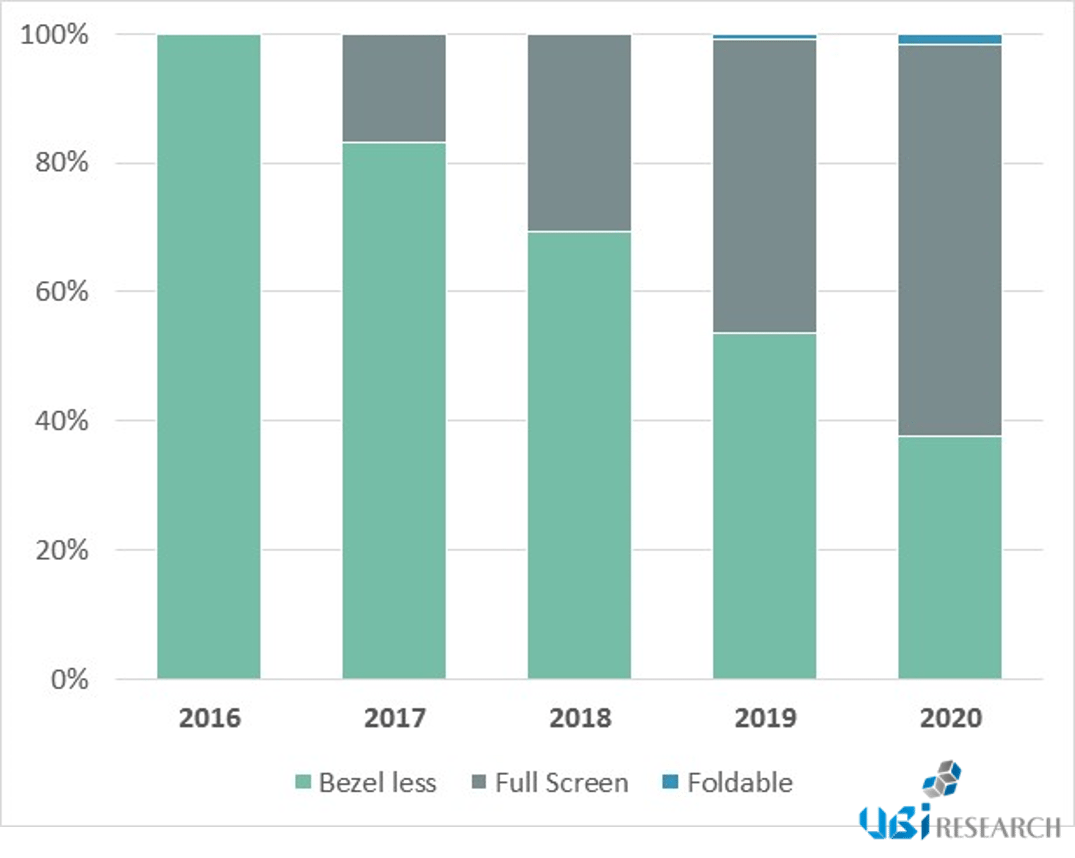

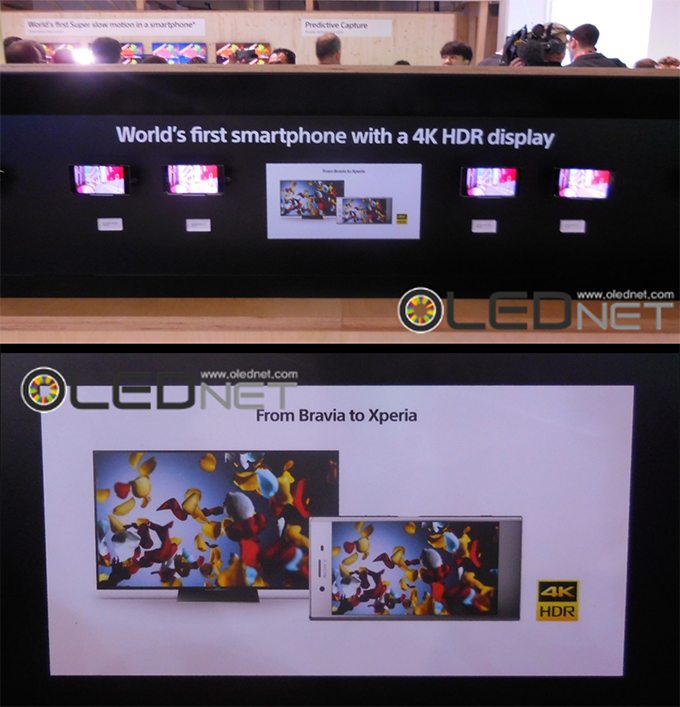

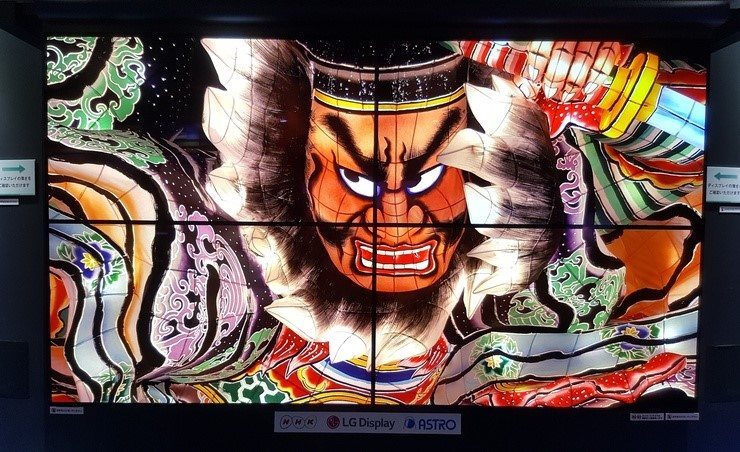

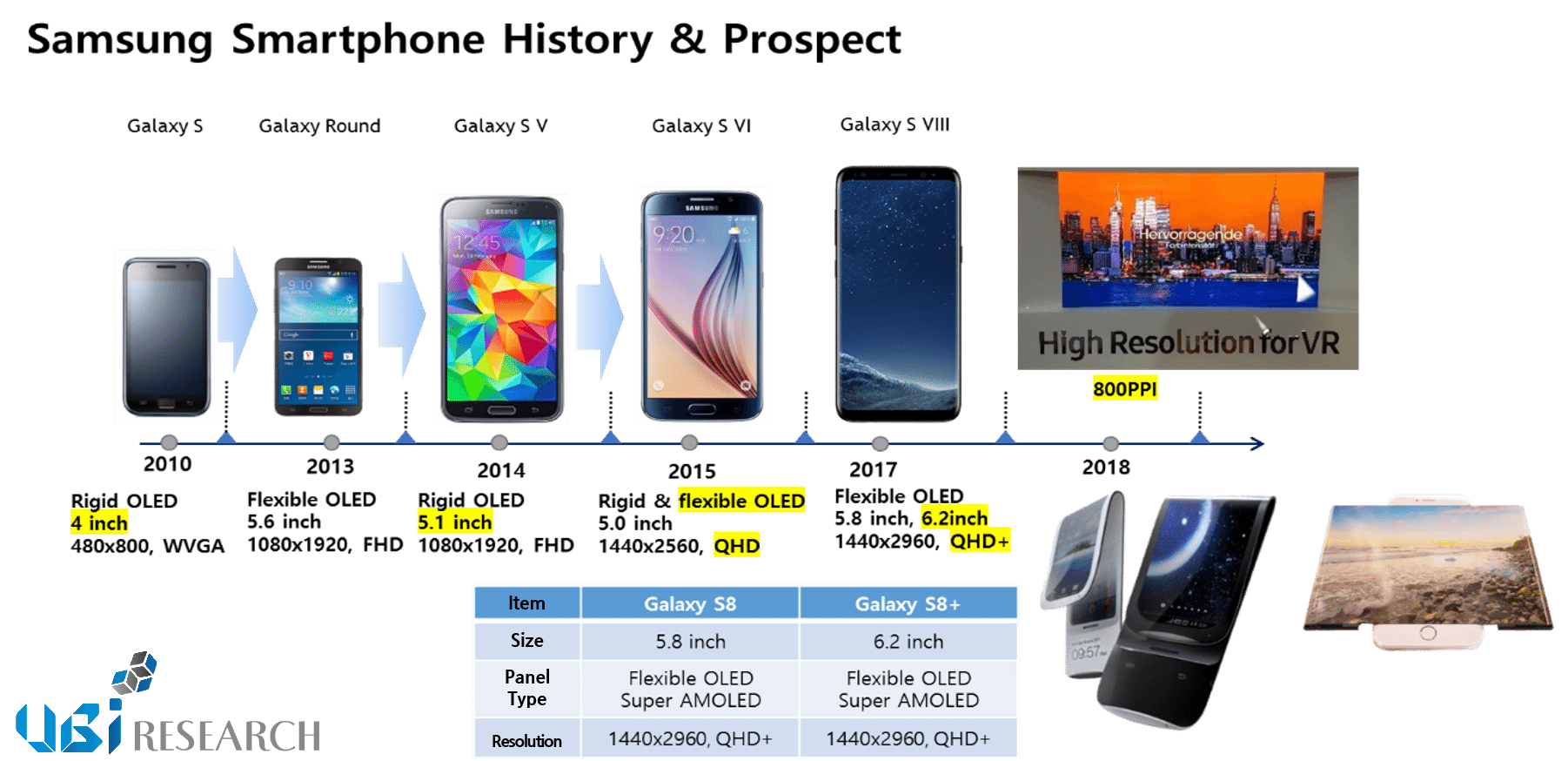

Looking ahead to the second half, the OLED business, Samsung expects demand for OLED panels to rise despite a likely slowdown in the smartphone market. To remain competitive, the company plans to actively address customer demand and reinforce profitability by expanding the proportion of high value-added products such as flexible and high-resolution displays. Samsung will also seek to secure supply capacity according to market demand while expanding its customer base and new applications.

As for the second-half outlook for the LCD industry, Samsung expects supply and demand to improve thanks to increased demand under strong seasonality as well as continuous UHD TV market growth and size migration towards larger screens. In response, the company will focus on enhancing profitability by improving cost competitiveness and expanding its portfolio to high value-added products including ultra-large size, high-resolution and curved panels.

Mobile Unit Strengthens Competitiveness Amid Slow Global Market

The IM Division posted KRW 26.56 trillion in consolidated revenue and KRW 4.32 trillion in operating profit for the quarter.

Samsung’s earnings improved QOQ thanks to strong sales of its flagship Galaxy S7 and S7 edge smartphones. Additionally the company achieved growth in the second quarter by maintaining the profitability of mid- to low-end models, such as the Galaxy A and J series, and improving the product mix by raising the sales proportion of the Galaxy S7 edge to over 50 percent.

Demand for smartphones and tablets in the second half is forecast to increase, however, market competition is expected to strengthen as other companies release new mobile devices. Despite this outlook, Samsung will focus on YOY earnings increase by strengthening its high-end line-up and maintaining solid profitability of mid to low-end products.

Looking into the third quarter, the release of a new large-screen flagship smartphone will help to maintain solid sales of high-end smartphones led by the Galaxy S7 and S7 edge. Samsung will also focus on expanding smartphone sales including this year’s new Galaxy A and J series and the debut of the Galaxy C series exclusively for the China market.

Samsung will focus on increasing smartphone sales under strong seasonality with the launch of a new model, while expecting marketing expenses to increase QOQ due to seasonality.

As for the Networks business, earnings improved due to increased LTE investment of major carriers in the second quarter.

Solid Performance for Consumer Electronics Despite Sluggish Market

The Consumer Electronics Division – encompassing the Visual Display (VD), Digital Appliances (DA), Printing Solutions and Health & Medical Equipment (HME) businesses – posted KRW 11.55 trillion in consolidated revenue and KRW 1.03 trillion in operating profit for the quarter.

In the second quarter, global TV demand remained flat YOY due to sluggish economic conditions in major emerging markets that offset the growth experienced in developed markets. Amid these challenging conditions, Samsung achieved solid YOY earnings by successfully launching new products, including SUHD TVs, and increasing sales of premium products on the back of global sporting events.

For the appliances business in the second quarter, although growth momentum continued in North America, global demand declined YOY due to slower growth in China and the impact from the economic slowdown in emerging markets. Despite these circumstances, earnings improved from the same period of the previous year thanks to increased sales of premium products such as the Chef Collection refrigerator and the AddWash and activ dualwash™ washing machines.

Looking ahead to the second half, TV demand is expected to decline YOY due to weakened demand in Europe and a prolonged economic slowdown in emerging markets. In response, Samsung will focus on improving profitability and increasing sales through collaborations with local channel partners and through region-specific promotions. To reinforce its leadership in the premium TV segment, the company will also seek to grow sales of its premium SUHD TV line-up, particularly products featuring its Quantum Dot technology.

Concerning the outlook for appliances in the second half, market growth is expected to be limited due to the aforementioned concerns in Europe and emerging markets. Despite these conditions, Samsung will actively seek opportunities to counter the challenging market dynamics by launching innovative products that offer superior consumer experiences. The company also plans to achieve further growth by enhancing its B2B business in this sector, particularly for built-in kitchens and system air conditioners.

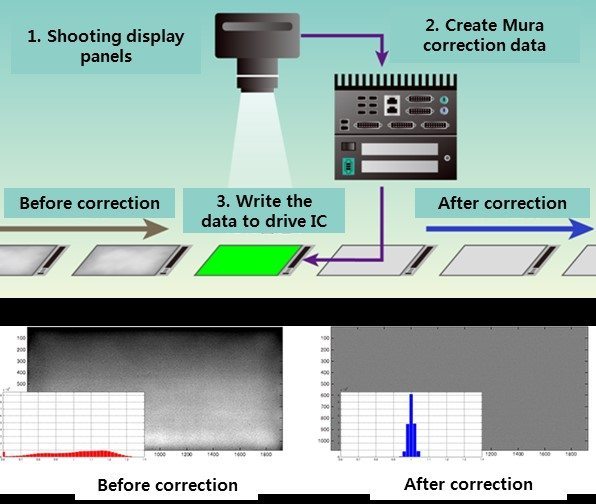

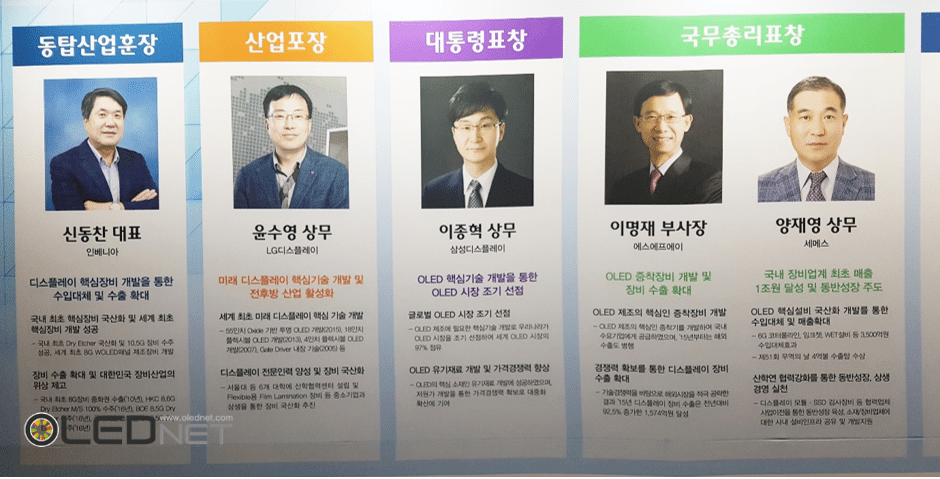

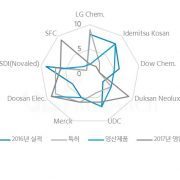

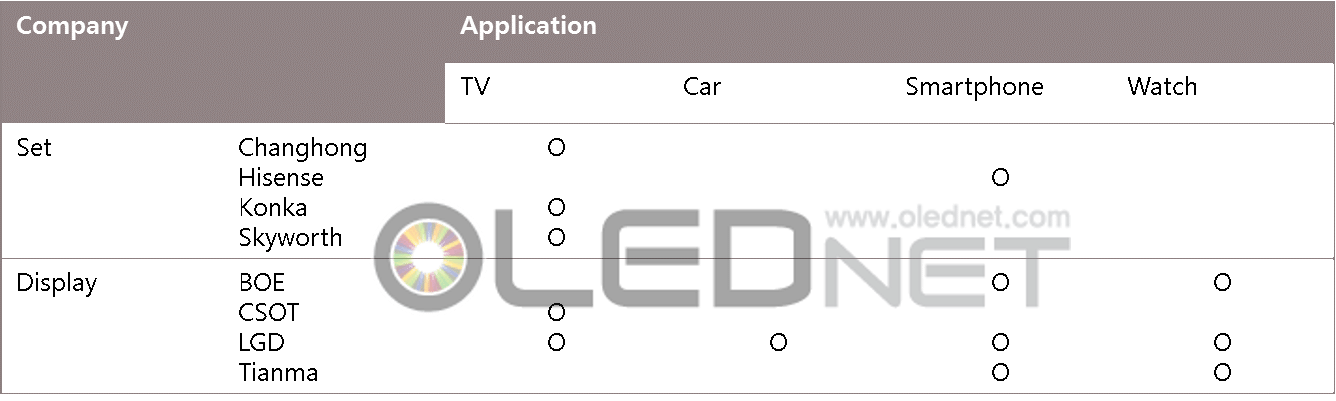

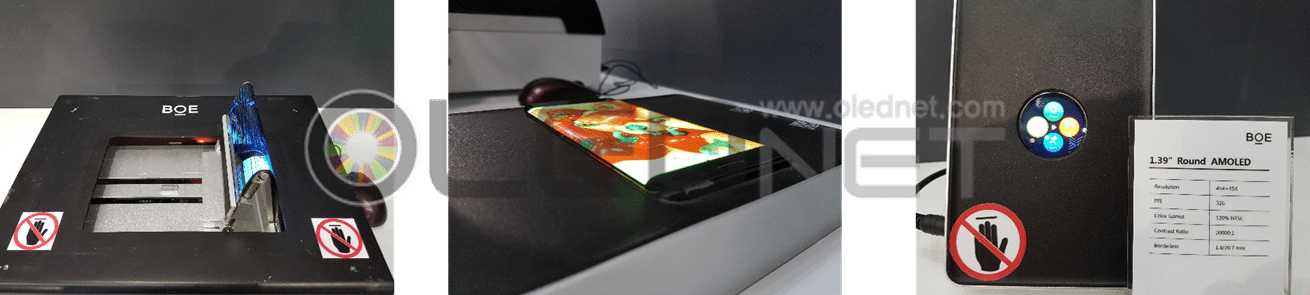

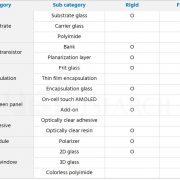

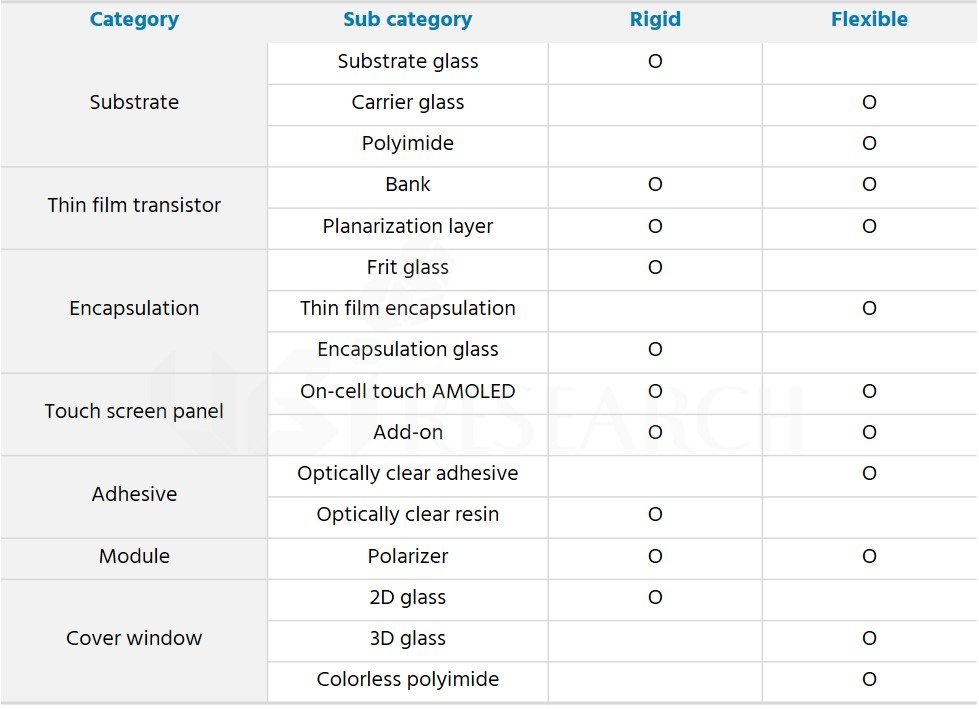

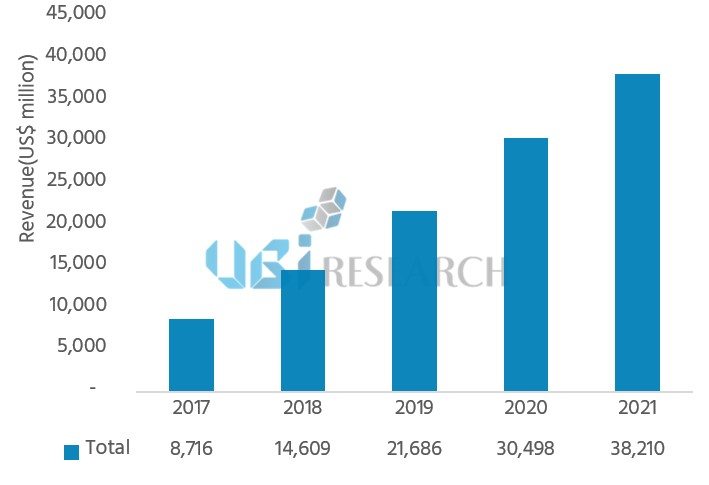

The component and material necessary for manufacturing OLED include not only board but also TFT, OLED, encapsulation, touch screen, cover window, and drive IC.

The component and material necessary for manufacturing OLED include not only board but also TFT, OLED, encapsulation, touch screen, cover window, and drive IC.