[Analyst Column] Korean Display Industry Is On Descent

Dr Choong Hoon Yi, UBI Research Chief Analyst, ubiyi@ubiresearch.co.kr

The analysis of 2015 2Q results of Samsung Display and LG Display shows clear indication that Korean display industry is on descent.

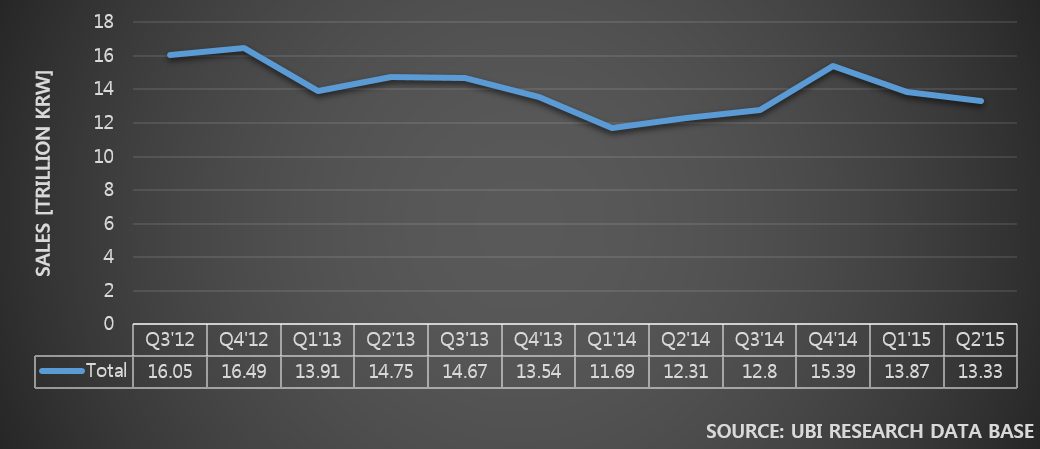

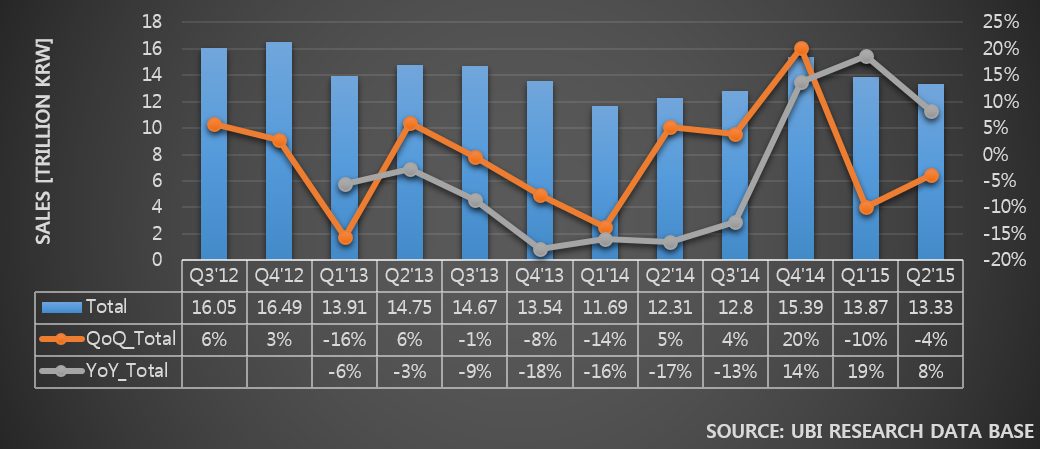

[2015 Q2 Korean Display Total Sales Analysis]

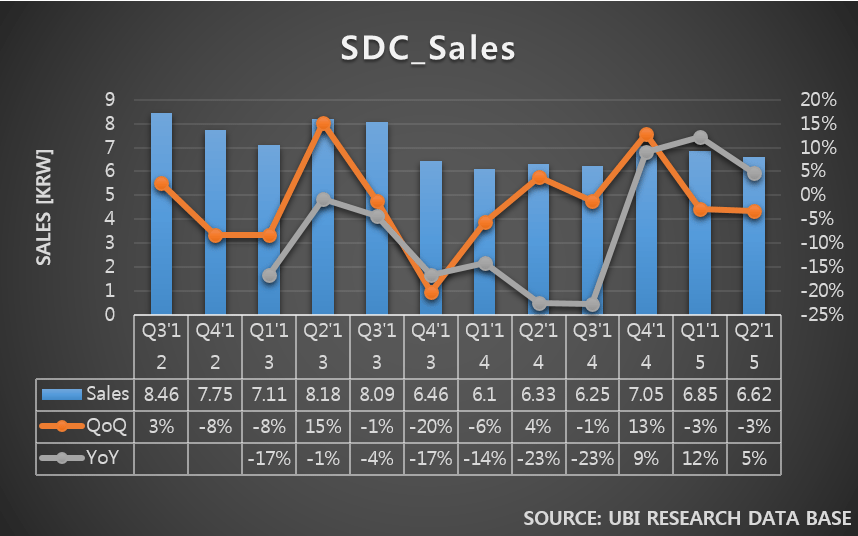

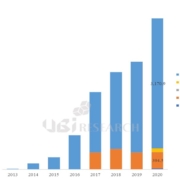

According to the results announcement of the 2 companies, the total of 2015 Q2 sales is approximately US$ 11,000,000,000. Compared to the total sales in 2013 Q2 which was US$ 13,000,000,000, Korean display industry trend is exhibiting clear downward tendency.

2015 Q2 Korean display sales records -4% QoQ, and 8% YoY.

The main reason for the decrease in sales is Samsung Display’s deterioration of earnings results. While LG Display’s sales of the past 3 years remain fairly consistent but Samsung Display’s sales is gradually decreasing.

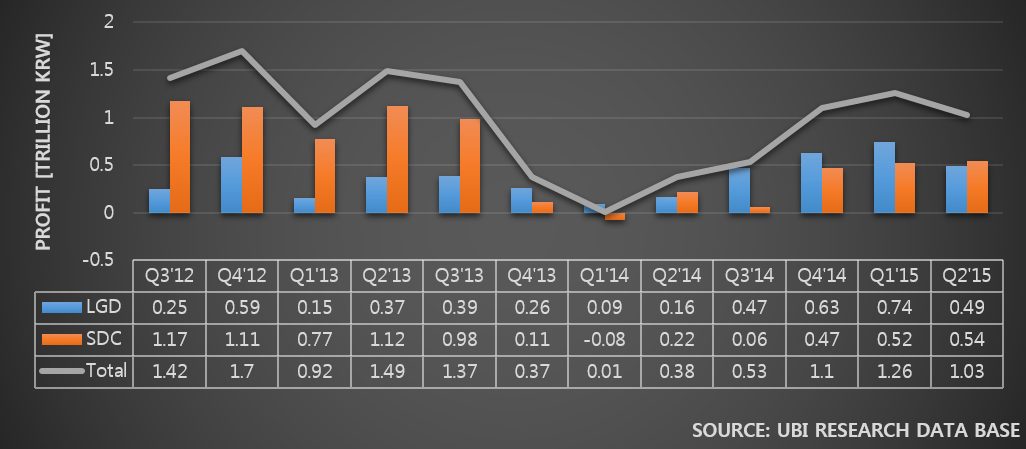

[2015 Q2 Korean Display Total Business Profit Analysis]

Connecting the high points of the total of 2 companies’ business profit reveal that the business value is worsening as the trend moves downward. This also is much contributed to Samsung Display’s business profit decrease.

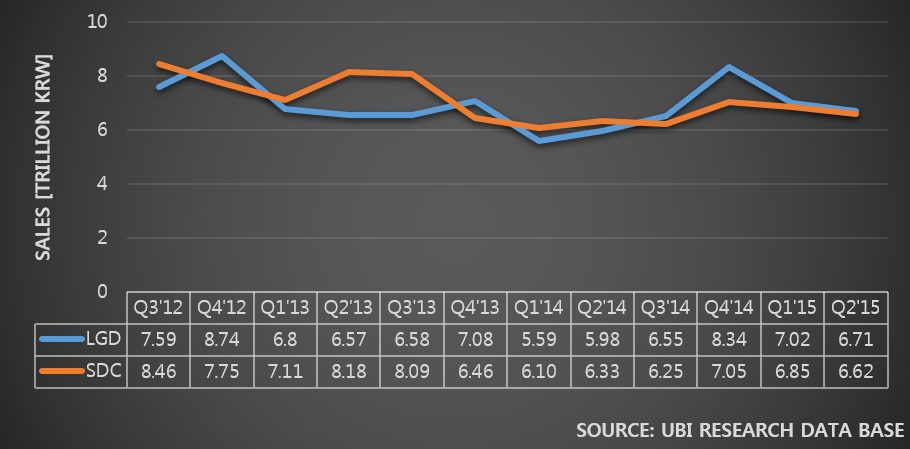

[Samsung Display and LG Display Sales Analysis]

According to the earnings announcement of both companies, Samsung Display and LG Display recorded sales of approximately US$ 5,500,000,000 and US$ 5,600,000,000 respectively. LG Display is maintaining higher sales results compared to Samsung Display for the past 5 quarters. Each company’s QoQ showed to be -4% (LGD) and -3% (SDC) and YoY to be 12% (LGD) and 5% (SDC). The simultaneous decrease of QoQ sales of both companies demonstrates that the Q3 sales could also fall.

[Samsung Display and LG Display’s Competitiveness Analysis]

Looking at the profit/sales graph of Samsung Display and LG Display, it is apparent that Samsung Display showed superior competitiveness until 2013 Q3, but since then LG Display averaged higher.

[Conclusion]

The reason for the downward trend of Korean display industry is analyzed to be the fall of display panel price due to the Chinse display companies’ mass production through aggressive investment. Particularly, in or after 2017 when China’s BOE is estimated to begin Gen10.5 LCD line, LCD panel price will fall even more rapidly. This is forecast to lead Korean LCD industry to suddenly lose competitiveness. For Korean display companies that have immense LCD sales to show positive growth, it is time to expand OLED business that can be differentiated from Chinse display companies.

The only solutions for Korean display industry are OLED investment in large scale and conversion of LCD line to OLED line. At the time of BOE’s Gen10.5 line operation, Korean display companies also should respond with Gen6 flexible OLED investment and early establishment of Gen8 OLED line.

댓글을 남겨주세요

Want to join the discussion?Feel free to contribute!