LG Chem.’s OLED Lighting Business Toward LGD. What is the Future Direction?

It was announced that LG Display will take over LG Chem.’s OLED lighting business department. As the department that was leading the opening of OLED lighting panel market is being merged into LG Display, a significant change in OLED lighting industry is anticipated.

One of the merits of this merge is expected to be further improving OLED lighting panel’s mass production potential through LG Display’s existing OLED panel mass production line, labor, and technology. Additionally, when new investment of OLED lighting panel mass production line is being processed, time and cost can be reduced on the basis of LG Display’s manufacturing equipment/material supply chains.

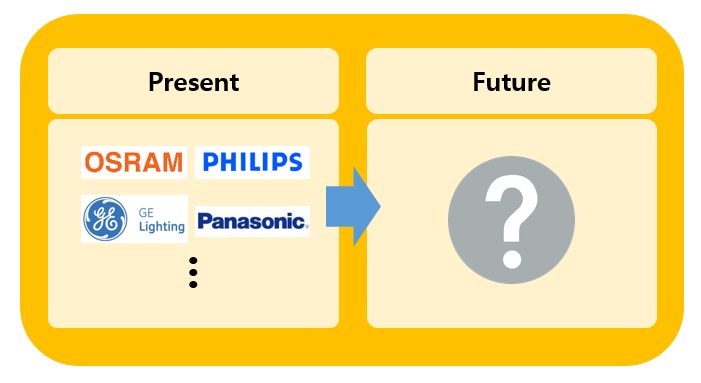

On the other hand, as OLED lighting market is still in initial stages the size is not so large. As such, whether LG Display will newly invest is a key issue. Generally, for display panel companies that invest with market size of thousands of millions of dollars in mind, OLED lighting panel line’s new investment does not seem to have a great advantage for LG Display.

Therefore, if LG Display carries out OLED lighting panel business, the first step is estimated to be mass production in parts of Paju’s AP2 line rather than new investment for OLED lighting panel mass production line. If parts of AP2 line begin mass production first, mass production timing can be much sooner than new investment and can positively affect expansion of OLED lighting panel market.

The issue is marketing strategy. In 2009, Samsung Electronics successfully opened AMOLED smartphone market in Korea via push strategy using AMOLED themed music video that became viral. Much like this, in order to show profit in OLED lighting panel business, LG Display should open the market through push marketing strategy.

![150309_ [Lighting Fair Japan 2015]LG Chem., 2015년 4월 100lmW의 OLED lighting panel 양산 가능3](http://www.olednet.com/wp-content/uploads/2015/03/150309_-Lighting-Fair-Japan-2015LG-Chem.-2015년-4월-100lmW의-OLED-lighting-panel-양산-가능3.png)

![150309_ [Lighting Fair Japan 2015]LG Chem., 2015년 4월 100lmW의 OLED lighting panel 양산 가능2](http://www.olednet.com/wp-content/uploads/2015/03/150309_-Lighting-Fair-Japan-2015LG-Chem.-2015년-4월-100lmW의-OLED-lighting-panel-양산-가능2.png)