Hyunjoo Kang / Reporter /jjoo@olednet.com

In the midst of UDC`s domination of 2015 global materials market, with Japanese Idemitsu Kosan`s rapid growth and slump of emitting materials companied, there has been changes to the enviroment.

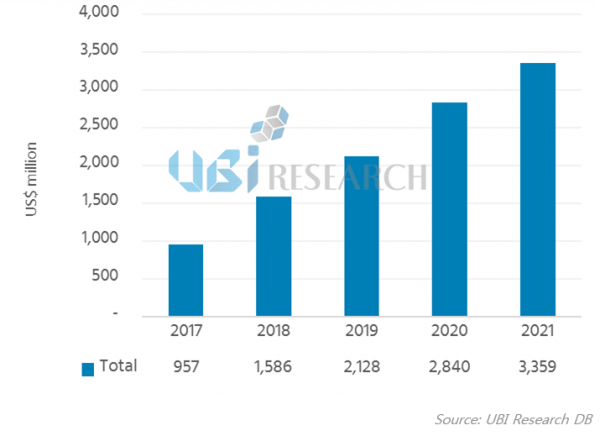

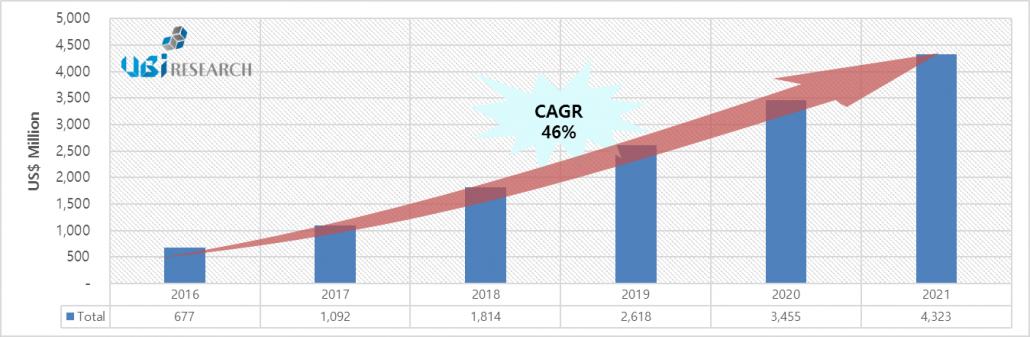

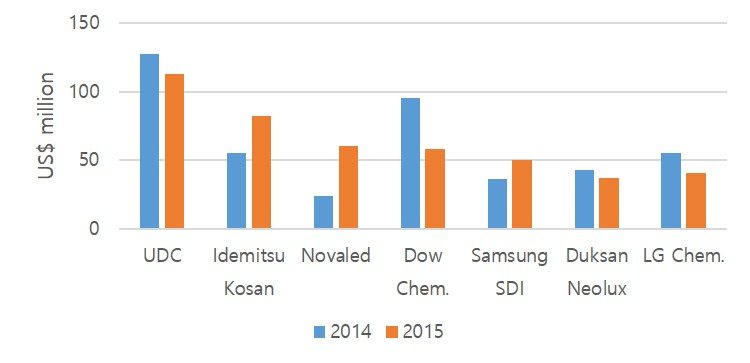

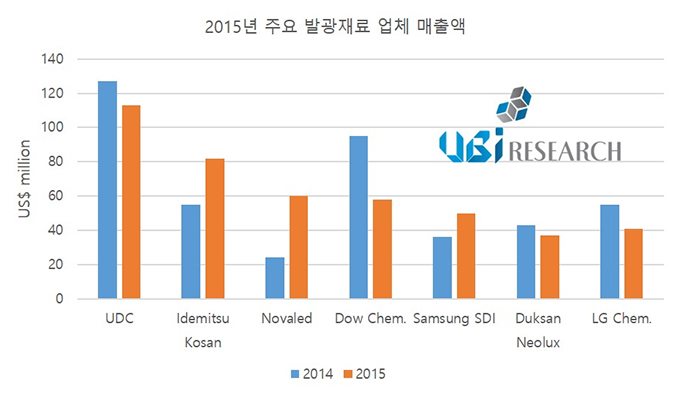

According to [2016 OLED Emitting Materials Annual Report] to be published by UBI Research in mid-April, the 2015 global emitting materials market recorded approximately a 17% growth compared to 2014

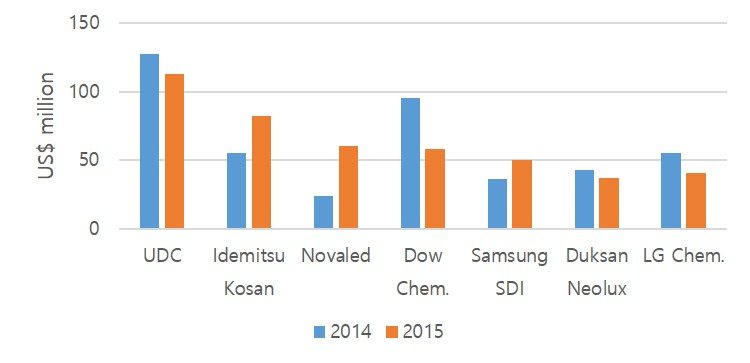

UDC’s revenue decreased from previous year, but remained at the top, the same as 2014. UDC was closely followed by Idemitsu Kosan despite its fourth place in 2014.

Such growth of Idemitsu Kosan is mainly due to its supply expansion in regards to Korean companies such as Samsung Display and LG Display. In 2015, Idemitsu Kosan began actively supplying Samsung Display with blue materials. Together with the increase in Idemitsu Kosan’s client LG Display’s OLED panel for TV mass production line’s operation rate, Idemitsu Kosan’s supply increased.

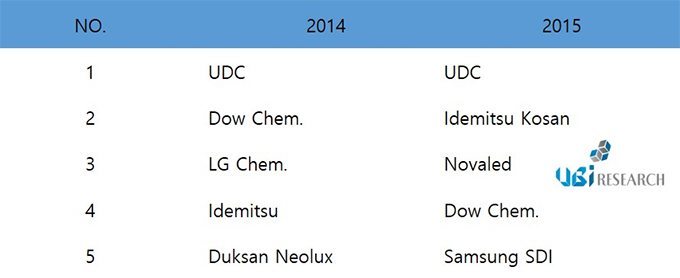

2015 Global OLED Emitting Materials Market Ranking

Source: UBI Research, 2016 OLED Emitting Materials Annual Report

◆ Samsung Display to Determine Up and Down of Companies

On the other hand, some OLED emitting materials companies that ranked high until 2014 showed poor performance. Dow Chem., that reached the second place in 2014 after UDC in revenue, fell to the fourth place in 2015 due to a big sales decrease. The third and fifth companies in 2014, LG Chem and Duksan Neolux respectively, fell below fifth place in 2015 due to the same reason.

Dow Chem. and Duksan Neolux are analyzed have recorded sales decrease in comparison to 2014 due to the supply chain changes of Samsung Display. In the case of LG Chem, the sales fell as the Samsung Display’s supply volume decreased.

However, Samsung SDI recorded sales increase, and entered within the top 5 in 2015. This company’s performance improved as it supplied Samsung Display with green host.

The company that recorded greatest growth is a Germany company Novaled that Samsung SDI, then Cheil Industries, took over. This company recorded approximately 150% revenue increase compared to previous year, and reached the third place in 2015 following UDC and Idemitsu Kosan. With the increase in OLED panel for TV mass production line’s operation rate, Novaled’s revenue greatly increased.

UBI Research estimated that in 2016, LG Display’s OLED TV mass production line operation rate and Galaxy Note series’ material structure, to be mass produced in the second half, will greatly affect revenue of OLED emitting materials companies.